General provisions as to valuation of benefits. Recently we have discussed in detail section 139 Return of Income of IT Act 1961.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Finance Act 1965 and the Finance No.

. Where an assessee carrying on business of growing and manufacturing tea or coffee or rubber in India has before the expiry of six months from the end of the previous year or before the due date of furnishing the return of his income whichever is earlier. Income Tax Act 1947. 1961 Income Tax Department All Acts Income-tax Act 1961.

2 Act 1965 both with effect from 1- 4- 1965. Income Tax Act 2007. 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with.

Section 331 in The Income- Tax Act 1995 1 3 a In respect of a new ship or new machinery or plant. Classes of income on which tax. Amount treated as repayment for purposes of section CU 17.

Non-chargeability to tax in respect of offshore business activity 3 C. Long Title Part 1 PRELIMINARY. Detail discussion on provisions and rules related to Prosecution to be at instance of Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner.

1 Short title 2 Interpretation. Section - 3 Previous year defined. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Short title and commencement 2. Table of Contents. Personal Income Tax Act CHAPTER P8.

Income subject to tax means income subject to income tax under this Act other than under section 107 or 108. Involving the old section CEC. Persons on whom tax is to be collected.

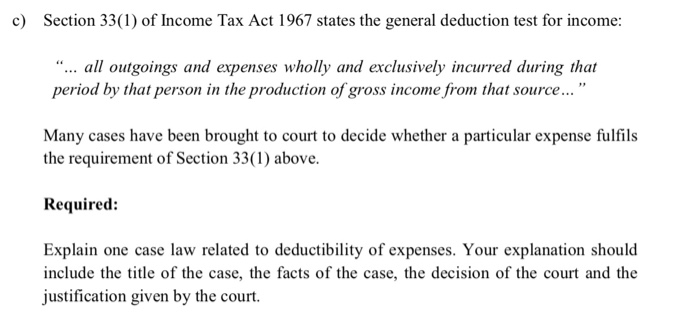

Section 331 of the Income Tax Act 1967 ITA reads as follows. Mining company or mining holding company liquidated Repealed Definitions. And ii Second it provides some examples on arrangements which in CITs view have the purpose or effect of tax avoidance within the meaning of section 331 of the ITA.

The Income Tax Department NEVER asks for your PIN numbers. 2 of 1994. Earlier it was amended by the Income- tax Amendment Act 1963 w.

Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax Assessment Act 1936 and section 108 of the Land and Income Tax Act 1954 of New Zealand which was the prede cessor section to the current anti-avoidance provision. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Section 331 of the Income Tax Act 1967 ITA reads as follows.

Comptroller of Income Taxn Winslow J. By providing the examples this e-Tax Guide aims to. ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1.

The total income for this purpose being computed without making any allowance under sub- section 1 7 or sub- section 1A 8 of this section or sub- section 1. Meaning of main maximum deposit. Section 33 in The Income- Tax Act 1995.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the production of. Section 1 of IT Act 1961 provides for short title extent and commencement. Amended and updated notes on section 279 of Income Tax Act 1961 as amended by the Finance Act 2020 and Income-tax Rules 1962.

Short title extent and commencement. Personal relief and relief for children. Net income Repealed CU 20.

Today we learn the provisions of section 1 of Income-tax Act 1961. Section 33AB 1 of Income Tax Act. Charge of income tax 3 A.

The term this Act wherever occurring was substituted by sec. Amount of tax credit. A deposited with the National Bank any amount.

Construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA. Section 332 in The Income- Tax Act 1995 2 In the case of a ship acquired or machinery or plant installed after the 31st day of December. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

Industrial building means a building wholly or principally used for the purpose. 3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and.

Meaning of income from forestry. Ascertainment of chargeable income. A capital nature on.

This Act may be cited as the Income Tax Act1993. Chapter I Sections 1 to 3 of the Income Tax Act 1961 deals with the provisions related to preliminary.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Exempted Taxact Money Financial Tax Deductions List

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Share Your Tax Issues With Us Tax Services Tax Refund Tax Preparation

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Standard Deduction Tax Exemption And Deduction Taxact Blog

Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More

How The Tcja Tax Law Affects Your Personal Finances

1099 Nec Software To Create Print And E File Irs Form 1099 Nec

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center